The blockchain revolution in the wealth management landscape is already underway, and offers a more secure and transparent means for individuals and organizations to build a more sustainable economic future: The age of DeWealth is upon us.

Facilitating real-time asset tracking, smart contracts for investment automation, and decentralized control over investor portfolios, blockchain has the potential to comprehensively disrupt legacy wealth management solutions and drive a digital transformation

landscape that no longer requires intermediaries or centralized banking.

Embracing the DeWealth Revolution

DeWealth, decentralized wealth, is a subset of DeFi (decentralized finance) and focuses on the use of decentralized and open-source technology that can be utilized by all participants.

The

core principle of DeWealth is that finance should be self-sovereign, self-directed, decentralized, and fully accessible to everyone.

As a result, DeWealth focuses on the decentralization of wealth management using blockchain technology in a way that provides greater autonomy, transparency, and security when it comes to managing wealth in confidence.

Tapping into cutting-edge technologies like self-sovereign identity, smart contracts, and non-custodial asset ownership, WeWealth offers unprecedented levels of control for users and streamlines compliance in a way that boosts efficiency.

At present, these concepts are still in their fledgling stages, and access to decentralized finance services can be difficult for those not accustomed to the world of cryptocurrency and blockchain. However, the mainstream growth of blockchain, an industry

forecasted to be worth $825.93 billion by 2032, is already breaking down the barriers to adoption.

This will pave the way for more functional compliance models and customer protection. It will also provide much-needed digital transformation for the wealth management ecosystem in its entirety, and will improve industry processes in a number of ways:

Streamlining Client Onboarding

Client onboarding can be a significant challenge for financial services due to the complexity of KYC (Know Your Customer) and AML (Anti Money Laundering) compliance checks and their time-consuming nature.

The delays that can emerge from these checks can carry a major opportunity cost in highly competitive markets, and challenger banks and the wider fintech landscape are laser-focused on

mitigating the inefficiencies throughout the onboarding process.

With the help of blockchain, however, this process can be streamlined in its entirety through the use of smart contracts and the immutable nature of chains, which offer a tamper-proof way of cross-checking prospective clients in a timely and accurate manner.

These efficiencies can extend to the wider frameworks surrounding credit scoring and risk assessment. Rather than relying on centralized parties like Experian or Equifax to perform credit checks, the financial history of prospective clients can be

referred to directly on the block for an instant overview of their associated risk in a more reliable and fair manner.

Enhanced Security Through Tokenization

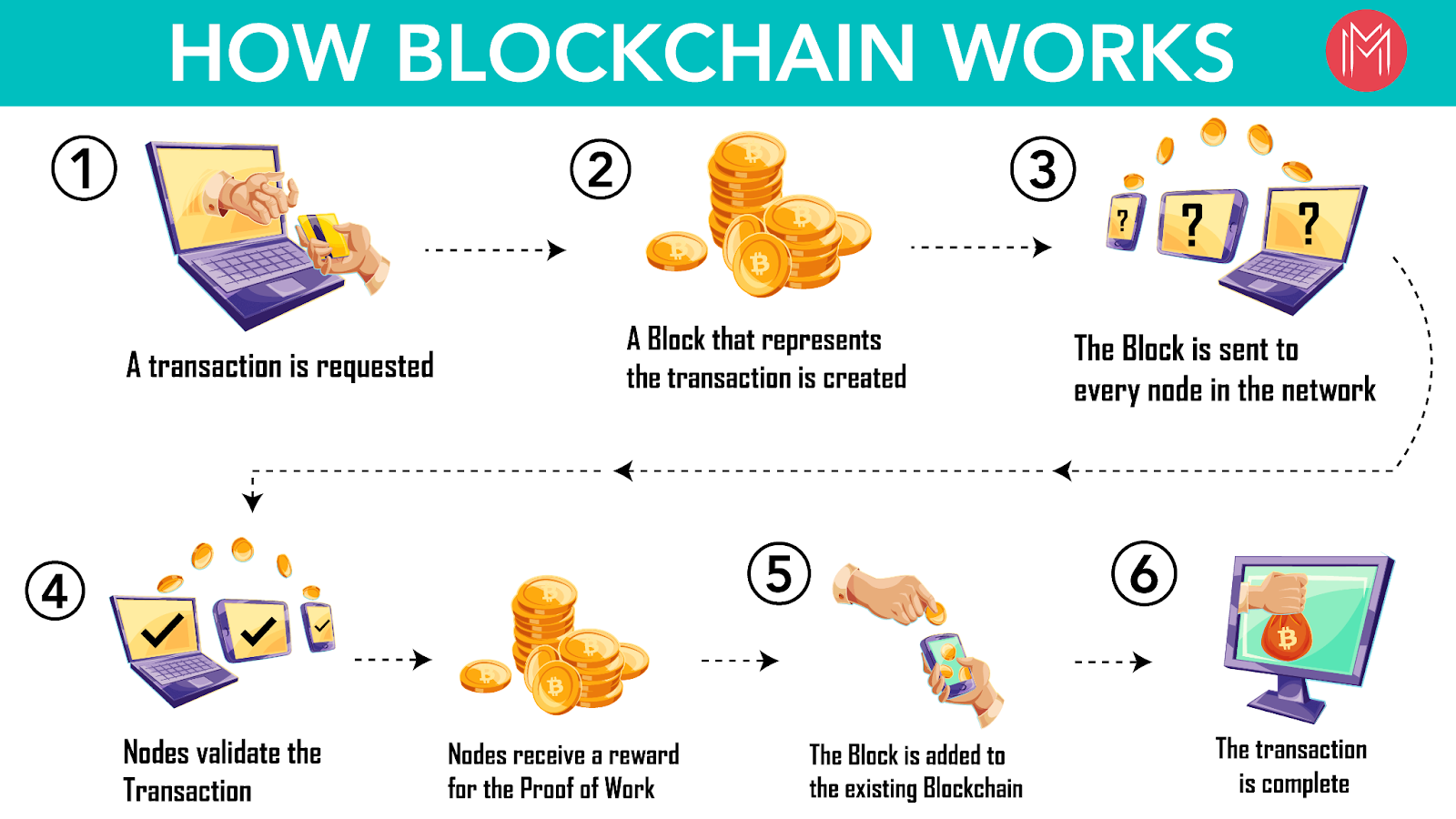

Additionally, the

tokenization of funds can pave the way for enhanced security throughout investment portfolios. This is because blockchains operate as distributed digital ledgers and are immutable, meaning that they cannot be tampered with or edited without the consensus

of its network of nodes.

For wealth managers, blockchain can complement existing security measures throughout financial planning strategies, and firms can benefit from utilizing the technology as a core component of their digital transformation strategy.

With processes like asset registration capable of becoming instantaneous on a blockchain, the technology can actively overcome old drawn-out processes in legacy platforms while supplying fund managers and advisers with enhanced data management capabilities

that offer a more cutting-edge insight into the performance of their clients.

Democratizing Inclusivity

The inefficiencies of traditional credit checks and KYC/AML requirements can be inhibitive for many users seeking access to wealth management services, and blockchain technology is well-positioned to

leverage leading financial services to the underbanked and even the unbanked populations of the world.

Focusing on wealth management, this doesn’t simply open the door to new opportunities to build wealth, but it also paves the way for brand new ways to build a nest egg or earn a passive income.

Built using smart contracts on blockchains, peer-to-peer (P2P) lending services can provide access to borrowing for individuals who may not be capable of accessing similar traditional services due to a number of reasons that can cause them to fail legacy

credit checks.

This provides a new avenue for those seeking to build their wealth by becoming a decentralized lender to secure new passive incomes backed by blockchain technology.

These revolutionary services can also be integrated into wider

wealth management digital transformation strategies for advisors to offer a more comprehensive suite of decentralized services to their portfolios.

Wealth Management on the Block

Deloitte research suggests that blockchain technology can carry a wide range of benefits in terms of transparency, security, and cost-effectiveness

throughout the wealth management landscape.

This will pave the way for the democratization of data transparency, book building based on smart contracts, and cost-effective bridges built by overcoming inefficient traditional processes such as KYC and credit checks.

As a result, wealth managers can benefit from a greater level of client understanding and will gain access to a more holistic overview of their operations and expand the suite of services available for clients.

Digital transformation in wealth management is beginning to gather pace, and blockchain promises to be the cornerstone of the DeWealth revolution.