In banking, AML (anti-money laundering) describes legally recognised rules and activities that financial institutions perform in order to combat money laundering. AML is closely attached to CFT (counter-financing of terrorism), and AML regulations tend to

combine money laundering (source) with terrorism financing (destination).

What are the main types of money laundering?

AML is closely related to organised crime (e.g., human, arms or drug trafficking) or illegal activities (e.g., embezzlement, smuggling, fraud). Money laundering refers to the act of taking money acquired through illegal activities and disguise the origins

in order to make it look like legitimate income. This generally happens in three stages: placement, layering and integration.

Placement refers to where and how the money is placed. This can happen via cash businesses, false invoicing, smurfing (placing small amounts that are lower than the AML threshold), foreign bank accounts or offshore companies.

During layering, the placement process essentially takes place over and over again with varying amounts, in order to create complex layers to further disguise the monies origins. Finally, the integration stage refers to the extraction of the funds back into

the economy under the guise of normal, legitimate business or personal transactions. This can happen in the form creating fake employees, giving out loans (that won’t be repaid) or paying dividends.

There are four main types of money laundering that financial institutions monitor and report:

- Trade-based money laundering

- Terrorist financing

- Drug trafficking

- Crypto/digital currency money laundering

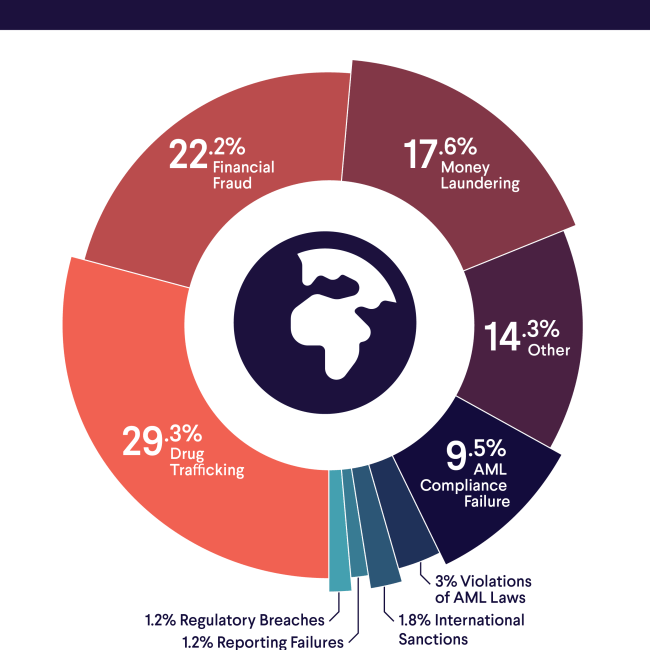

What’s the current state of AML?

SmartSearch recently released an

in-depth report investigating the state of money laundering from 2013 to 2023. The report found 2022 was the worst-recorded year for AML events, with almost 25% worldwide total events (4,363 out of 16,150) occurring in that year alone. In the US, $14bn

in penalties were handed out in 2022 across almost 3,200 AML events, involving almost 280 organisations and 5,000 individuals.

Source:

SmartSearch

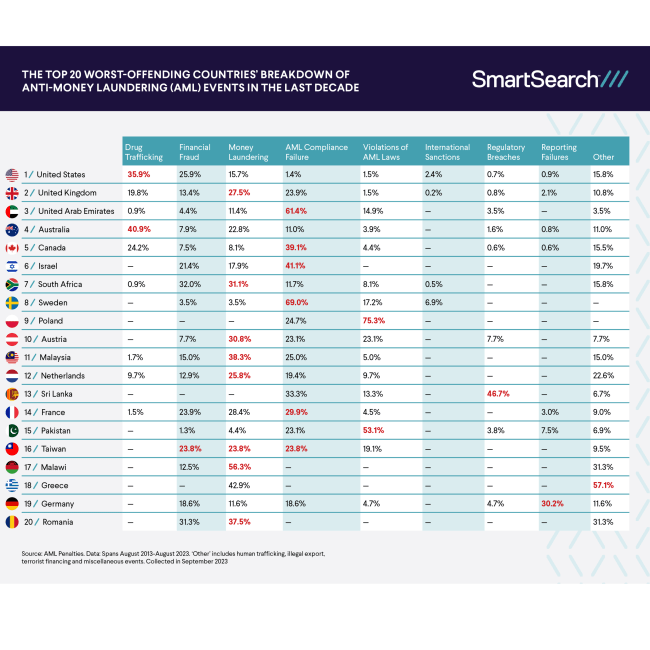

Breaking AML down by country, the US is the country with the most AML events (both per capita and overall) over the ten year period, followed by the UK, United Arab Emirates, Australia and Canada. Notable, in the UK, money laundering is the most common AML

event (27.5%), followed by AML compliance failures (23.9%).

Martin Cheek, managing director at SmartSearch, comments: “The notable occurrence of AML compliance failures in the UK, at 23.9%, is pretty shocking. While the figures span a whole decade, which means technological advancements and reforms of laws and regulations

will have helped to combat compliance failure in more recent years, this figure is still too high.”

Source:

SmartSearch

What AML regulations are in place?

Globally, various legal requirements have been put in place by regulatory bodies across different jurisdictions.

UK: The Money Laundering, Terrorist Financing and Transfer of Funds Regulation requires businesses to follow various AML requirements. It was amended in 2019 to transpose the EU 5th AML Directive into national law (the UK decided not to transpose

the 6th AML Directive due to the fact that most of it was already covered by UK law).

EU: In 2021, the European Commission adopted an anti-money laundering and countering the financing of terrorism (AML/CFT) legislative package, including a proposal for a

6th AML/CFT directive (6AMLD). On

18 January 2024, EU Council and Parliament reached a provisional agreement on the Directive as part of the anti-money laundering package.

North America: The Bank Secrecy Act (BSA) in the US requires financial institutions to help federal agencies detect and prevent money laundering. In Canada, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) requires institutions

to establish and maintain a comprehensive AML compliance program.

Australia: The Anti-Money Laundering and Counter-Terrorism Financing Act of 2006 establishes the legal framework that requires institutions to prevent, detect, and prosecute money laundering and terrorism financing activities.