Namibia is quite small in terms of population. Also it has been under South Africa’s wing for a long time before going independent. These two facts are enough to tell me that there might be just nothing interesting going on in fintech and payments space

in Namibia.

So WTM went there to see for ourselves.

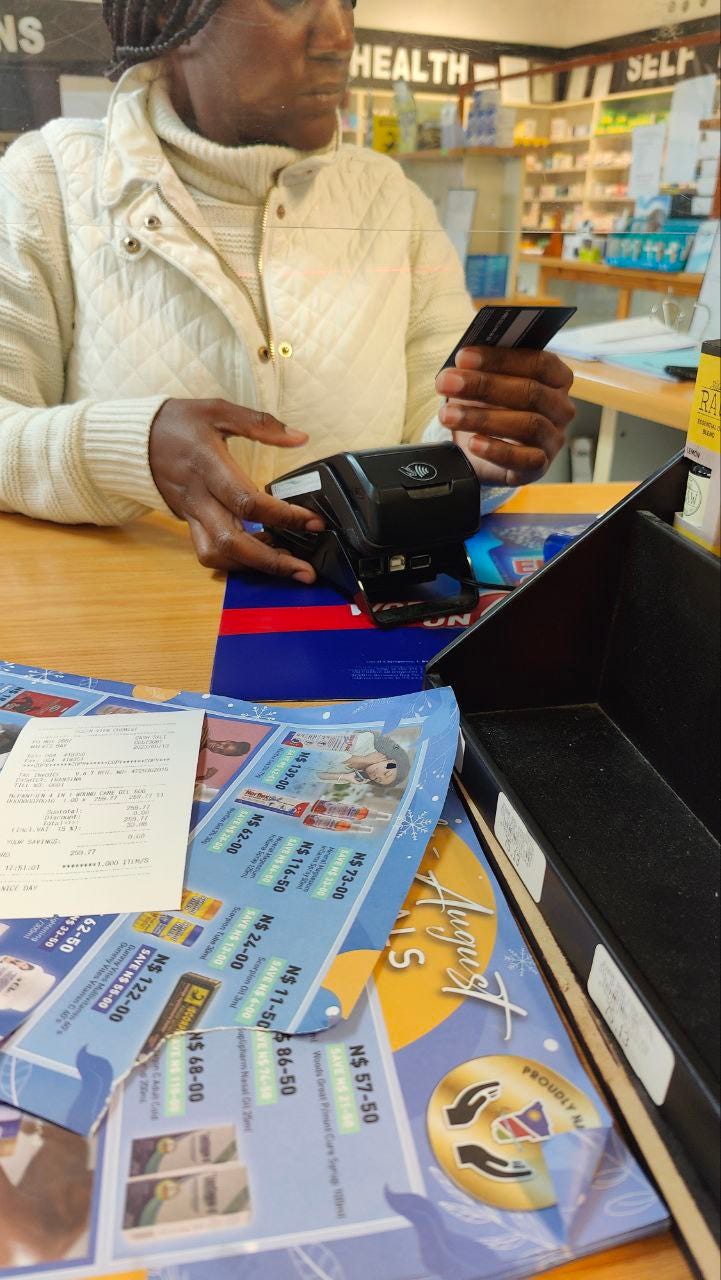

Just like South Africa, Namibia is very well covered in terms of bank card payments. Offline POS terminals are generally ubiquitous in larger urban areas, gas stations or any touristic hotspots. However, there was a slight twist. While able to support NFC

contactless payments, these machines were not supporting them in most locations. This seems to be an anti-fraud measure, with the need for user convenience not being strong enough to power through the executives.

Cash is still the one and only reliant way to get your expenses covered. But honestly, we managed to get by with bank card payments almost everywhere.

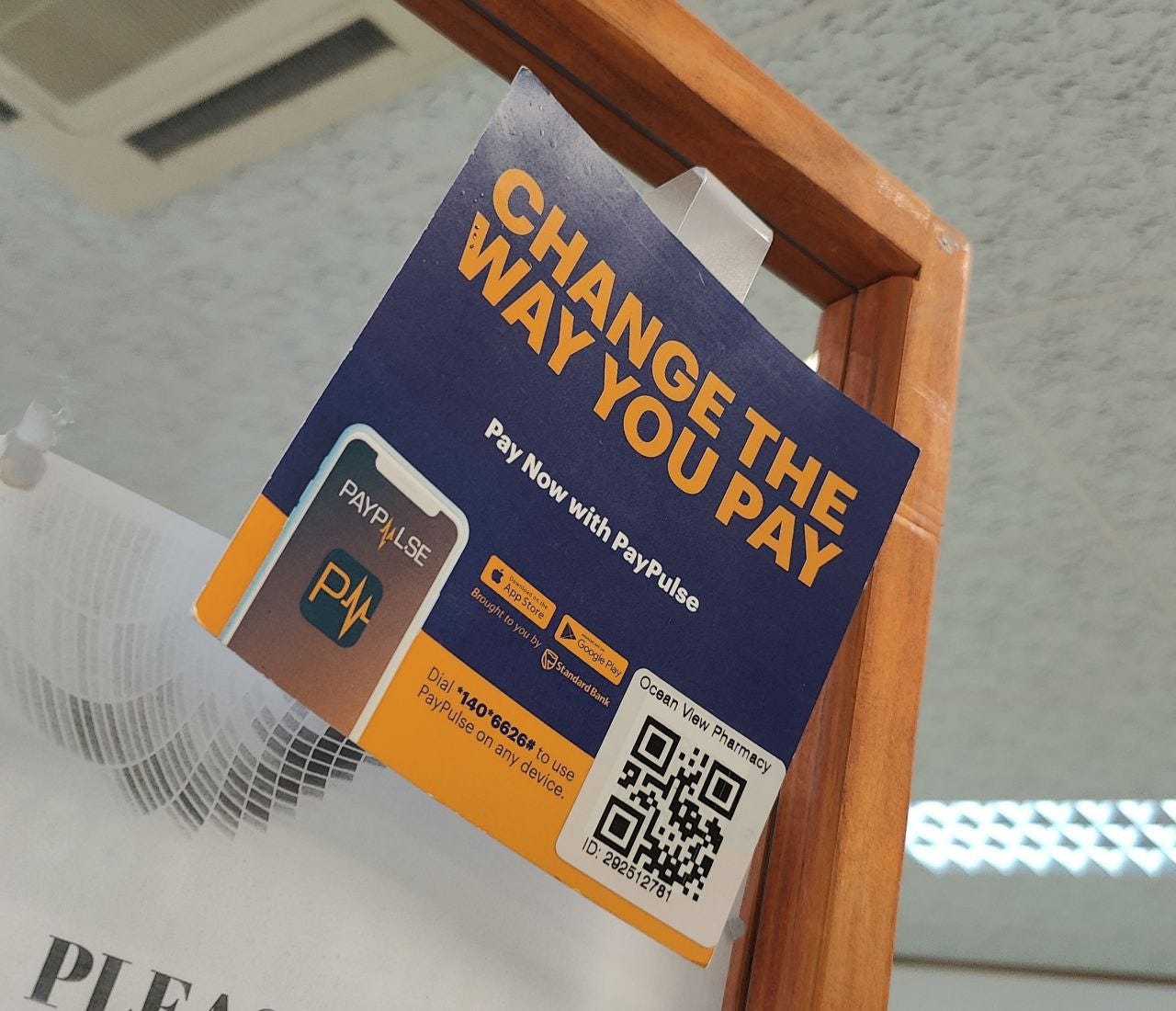

We have noticed a few famous money transfer systems, and learned about local mobile wallets like PayPulse that cover what any wallet should: everything from utility payments to money transfers to QR-code payments at supported merchants. Frankly, we did not

find that many QR-codes in the stores, but perhaps when living like a local, it might become handy.

Namibia is forcing digital innovations: thus, FNB has introduced convenient hubs and zones with access to multipurpose ATMs and free Wi-Fi. In summer 2023, Namibian president signed a bill laying out a local path forward for the crypto and digital assets.

That would be the end of our story about Namibian fintech. If it wasn’t for the trust in people.

You heard me, trust in people. The most amazing piece of fintech we found on the Namibian soil was… the cashierless stands selling crystallised salt. Competely cashierless, based on trust. You take, you give. Just have some faith in people.

Trust is the first technology that is implemented, before you get to camera motion sensors and behaviour tracking in modern cashier less stores. I believe that the cash jars could be replaces with the phone number or QR-code for payment, if such technologies

were common in Namibia. But it is mostly the approach to sales that is wonderful here.

So here you go, Namibia. Might not be the most developed in tech, but you sure make up on the vibes.

___

Anna Kuzmina

‘What the Money?’