Most people can remember a situation in their lives in which they experienced a huge amount of stress when dealing with money. Whether it was a bad encounter with online banking, a struggle when planning a budget or keeping track of spending, the

majority of us can relate. But, how often do we wonder about how these situations can impact our lives, and those of our families and loved ones? In order to create a responsible financial UX design, it's vital to understand the role that human emotions play

when it comes to money.

Poor Financial UX Could Lead to a Dreadful Tragedy

On June 12-th, 2020 a 20-year-old Nebraska college student Alexander E. Kearns committed suicide after misinterpreting the interface of millennial-focused stock trading app Robinhood that showed he had a negative cash balance of $730,165.

Screenshot of Alexander Kearns mobile phone, published by Bill Brewster in his twitter account @BillBrewsterSCG, June 17, 2020

Bill Brewster, Sullimar Capital analyst related to Kearns family, in his comment to CNBC criticized the way Robinhood displays trade summary: “When you’re dealing with retail money and actively soliciting traders under 30 years old, to have errors like this

is inexcusable and at the minimum negligence.”

In online published suicide note, Alexander Kearns asks: “How was a 20 year old with no income able to get assigned almost a million dollar's worth of leverage?"

While Robinhood app displayed in red Kearns’ negative $730,165 cash balance, it showed his temporary balance and would be corrected after the stocks underlying his assigned options actually credited to his account. But it seems Kearns unfortunately did not

know about such nuances of options trading. A small pop-up with an explanation could stop the tragedy.

Personal budget, money management and financial trading are a highly sensitive topics and not something we tend to discuss with people around. Money has a major impact on our lives. Even a minor user experience problem in financial user interface can cause

major consequences. A well-designed financial user experience could save relationships, families and even people's lives.

Money is Causing Dramatic Emotions That Ruin Lives

Financial institutions, such as banks and Fintech companies, are seeking solutions. Many are already doing a lot to help their clients have a pleasant financial experience and manage their money by offering various easy-to-use solutions. However, according

to a survey from Independent, in 2018, money worries are still the leading cause of marriages falling apart.

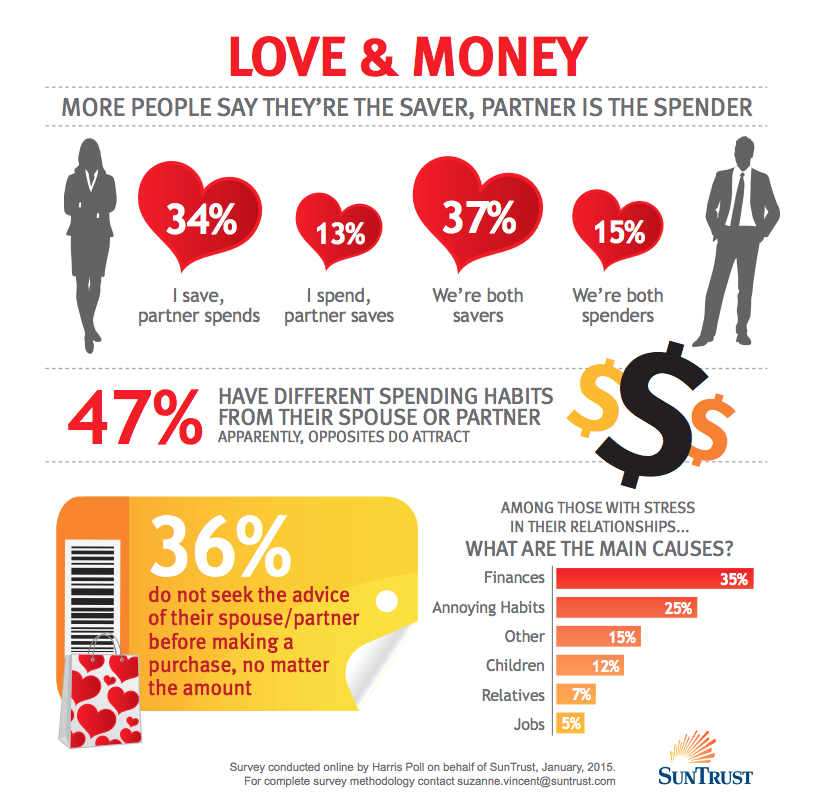

Another study named “Love & Money” from SunTrust Bank showed that that Finances are the main reason of stress in relationships, where 35% of all respondents who experienced relationship stress named money to be the main factor causing issues. On a more positive

note, this is a chance to inspire Fintech companies and banks to conduct research into how and why people make bad financial decisions.

Infographic from SunTrust.com Newsroom

A while ago, I heard a story from a friend about a family who experienced a lot of struggle due to financial problems and eventually broke up. The reason for this divorce was not because the parents hated each other. Rather, they hated conflicts about the

irrational behaviors that occurred, and how they couldn't control each other financially. Both parents in this family were working and received their monthly salaries on a regular basis.

However, after receiving their salaries, they made many impulsive purchases, resulting in unpaid bills at the end of the month and each others confrontation. Both of them felt like there was nothing wrong with their irrational spending. Moreover, they did

not even realize that their own purchases weren't reasonable in the first place. Instead, they were trying to justify and rationalize their behavior. In conclusion, the husband and wife had multiple disagreements and decided to divorce. Due to difficulties,

divorce and financial struggle, the life of this family was destroyed.

But, what if a third party had been involved? Something that could assist them with their finances by giving feedback and insights about their budgeting, help to manage their spending and potentially eliminate future errors? What, then, is the chance that

this family would still be together?

I remember an interesting episode of a TV show called ''Planet of the Apps,” in which new startup companies present and defend their app ideas in the hopes of receiving funding. One of the judges, actress Jessica Alba, commented as follows on a personal

finance management app that was presented: “As a kid who grew up in a home that was living paycheck to paycheck, if they only had this tool, 90% of the arguments in my house wouldn’t been about money.”

Hearing real stories like this can make us truly appreciate the opportunities that well-designed modern technology can offer. Back in the day, people did not have access to a personal finance manager that was just within their reach─on their smartphones.

Needless to say, the times have greatly changed, but the financial problems in families still exist.

Knowing this, it is now the responsibility of financial companies to design digital financial services that will help people to effectively manage their money in an effort to reduce or even eliminate negative emotions and financial frustration. Unfortunately,

not all companies can understand and evaluate the impact and consequences of how certain financial situations can affect people's lives both positively and negatively.

It is critical to focus not only on designing the services as transparently, user friendly and simple as possible, but also on understanding how emotional finances can be for people and what dramatic feelings and reactions it can cause. Why do some people

act irrationally when faced with a financial decision and cannot control themselves? When we place major significance on something in our lives, everything that revolves around it can easily cause strong emotions, such as alertness and unreasonable reactions.

Behavioral Economics as a Key to Financial Irrationality

Good designers can't get enough of the fact that, when designing a product, you start with the user and not technology. In order to bring real significant value that will leave an impact on society and even help to save families and improve people's lives,

the key factor is to understand the user’s behavior, psychology and key pain points. Learning to empathize, understanding what problems need to be solved and then applying the technology will make a difference.

People like to think of themselves as rational consumers, and there’s a reason for each action we make. In reality, our minds can trick us into making choices that might seem logical, but actually don't bring rational value. These tendencies to think in

a certain way that can lead people into deviations of rationality and good judgment are called “cognitive biases.”

For some people, the following fact might sound a bit harsh, but, according to behavioral economics, people can be and, in fact, truly are irrational beings who make poor, nonsensical decisions driven by emotions. The challenge, then, for product designers

is to put great effort into analyzing the cause: why users do things the way they do, what motivates them and what are their habits and fears.

1. The Trap of the Path of Least Resistance

You have probably seen this a lot when walking around the city. There's a beautifully made pedestrian walkway, and then there's an actual more efficient and desired footpath adjacent to it. The pedestrians will obviously choose the path that takes them from

one point to another the fastest, thus being the less resistant one.

As stated by Dan Ariely, a professor of psychology and behavioral economics at Duke University, when it comes to making decisions, most people tend to look for the least resistant route, even when it's not always the best choice.

Behavioral economics can also be used when designing user experiences, in order to improve the financial decisions that people make in their everyday lives. If we think about people who constantly make irrational financial decisions, choosing the least resistant

route can be influenced by a sense of easier and better decision-making.

As an example, let's consider a major decision that most people have to make in their lives━which financial service will be the right one for me? Whether it's a central or commercial bank, credit union, loan association or Fintech application, the first

thing that user needs to do is to decide on a reliable and recommended service. In order for that person to make the best decision, company information and testimonials should be provided.

It is important for millennials today to understand the main goal of the financial company. Is it only to raise their profit or is it to create a pleasant and life-changing experience for their customers?

2. Wealth Irrationality Evokes Overspending

Experiencing certain fluctuations in financial situations, such as a sudden increase in wealth, is also the cause of human irrationality and unreasonable spending. The “wealth effect” idea states that spending increases or decreases as the perceived wealth

level increases or decreases. Thus, when people perceive themselves to be richer, they have a tendency to spend more. There's even a term called “sudden wealth syndrome,” in which people who become overwhelmed and start to overspend tend to make poor decisions

that can even result in familial and financial ruin.

It is important to have a financial tool that can help manage finances and focus on the user’s needs. When we buy something new and desired, the pleasure center of our brain gets activated, resulting in quick and temporary boost. In situations like these,

people often need to be advised and guided into making the right actions just as much as if they were in financial difficulty.

There are various ways in which well-designed apps also take advantage of behavioral economics and “nudge” people to save more by bringing rationality into their spending. For example, the app can give alerts if you're about to miss a payment or you've overspent

your budget in a particular category, such as dining out.

Well-designed financial platforms that help users to maintain and improve their financial well-being are highly likely to acquire their loyalty and position themselves as a trusted advisor.

3. Human Brain Produces Impulses that Destroy Well-Being

Do you know how human brain reacts when faced with a financial decision? Why does it work in a certain way? Is it logical, rational, cautious or emotional? A science called neuroeconomics seeks answers to these questions for financial choices we make by

analyzing our brain and its functions. Understanding how our brains function and how we process information can also benefit the financial UX designers in order to create better financial experiences, resulting in smarter decisions.

Here's a test question: which goal is more important━buying a new iPhone now or saving that money for your retirement? This question might sound silly, but, in reality, consumers brains would often make us choose the first option in order to satisfy the

current desire instead of a distant goal far in the future. However, what happens if we tend to satisfy our short-term desires too often and result in stepping out of our safe budget zone?

Research named “Brain battles itself over short-term rewards, long-term goals” conducted at Princeton University concluded that humans would rather make impulsive preferences for short-term rewards, caused by the emotional-based parts of the brain winning

over the abstract-reasoning parts. As stated by David Laibson, Professor of Economics at Harvard University, the emotional brain has difficulties imagining the future, even though the logical brain can clearly see the consequences our current actions cause.

In the words of D. Laibson: "Our emotional brain wants to max out the credit card, order dessert and smoke a cigarette. Our logical brain knows we should save for retirement, go for a jog and quit smoking.”

When designing a financial platform, a large focus should be placed not only on defining users’ goals, but also some limitations. The boundaries can be really helpful when we manage our family budgeting, monthly spending and rationalizing between shorter

and longer-term goals.

A well-designed platform will help users reach their goals by implementing some basic rules, tips and information for alerts, which can be triggered when a goal measure is outside of some limitations. For example, when we receive a notification about a bill

that needs to be paid, sometimes we keep postponing it and might even forget it. A new alert, after some time has passed when not paying the bill manually, would be for either an automatic bill payment setup or only requiring the user to click one button to

pay the bill.

4. Social Media Pressure Leads to Irresponsible Decisions

Young people are faced with a lot of challenges when it comes to saving money. Due to the monthly apartment rent, utility bills and student loan payments, millennials have to carefully think about what financial decisions to make in order to manage their

lives. Some factors, such as having a good role model when growing up and financial education, can help young people to examine money rationally and not go overboard. However, a huge factor influencing that is social media.

Of course, these platforms, without a doubt, can make a very positive contribution in our lives. They offer people a chance to have a voice, to create and share content and to connect with one another all around the world. But, what exactly happens when

we regularly browse the thousands of pictures, videos and posts added and shared by our friends and strangers, and how does that impact our financial routines and habits?

The “Generations Ahead Study” by Allianz Life Insurance Company, which examined social media's impact on American spending habits, discovered that nearly 90% of millennial respondents admitted that social media creates a tendency to compare their own wealth

or lifestyle to others. Fifty-five percent of people stated that they experience fear of missing out (FOMO). They feel inadequate about their own lives because of something they saw on social media, such as people with flashy lifestyles going on expensive

vacations and posted branded clothing in Instagram stories.

As a result of all this, in an attempt to keep up with their peers, more people are spending excessive money on unplanned expenses. In many cases, this results in people living off of loans and declaring bankruptcy. A famous quote by the actor Will Rogers

greatly captures the main idea behind why a lot of people experience financial struggle and act irrationally. “Too many people spend money they haven't earned, to buy things they don't want, to impress people that they don't like.”

A positive insight of this research states that 71% of millennials use “tricks” to save money, and 70% use online tools or apps to help them manage their finances. Developing good financial skills and using these tools at an early age can greatly increase

our financial knowledge, allowing us to face and also conquer financial challenges in our adult lives.

Responsible Financial Services Design: A Path to Empathy and Safety

In the complex and often impersonal world of financial services, the design of user experiences holds a power that extends far beyond mere transactions and convenience. As demonstrated by the heart-wrenching story of Alexander Kearns and the turmoil experienced

by countless families struggling with financial management, the stakes are incredibly high. Financial UX design isn't just about creating systems that are easy to use; it's about crafting services that understand, empathize, and protect the user at every step.

The intersection of human emotions and financial decisions is a delicate one, where the wrong presentation or lack of clear information can lead to catastrophic outcomes. Kearns' story is a stark reminder that financial service providers must consider the

emotional and psychological impact of their designs. This means implementing safeguards, transparent communication, and educational resources that help users comprehend the implications of their financial actions.

Moreover, the potential of financial UX design to either alleviate or exacerbate stress in relationships and personal lives cannot be underestimated. With money being a significant source of contention and anxiety in many relationships, the role of empathetic

design in financial services becomes even more critical. By prioritizing user understanding and emotional well-being, financial platforms can transform from mere tools to supportive allies in navigating the complexities of financial management.

Responsible financial UX design goes beyond aesthetics and functionality; it requires a deep understanding of human psychology, a commitment to user safety, and a mission to empower individuals. By embracing these principles, financial service providers

can contribute to a world where technology not only makes financial management easier but also safer and more human-centered.

The journey towards responsible financial services design is not only a challenge but a next-gen opportunity. It's an opportunity to redefine the relationship between people and financial systems, to turn apprehension into confidence, and to ensure that

the digital advancements in finance become a force for good.