In today’s interconnected economy, efficient cross-border payments are crucial for businesses and individuals alike. Yet, traditional payment methods often face challenges such as delays, high costs, and limited transparency. Fortunately, recent innovations

in financial technology, notably the adoption of the ISO 20022 messaging standard and machine learning, offer promising solutions to these issues.

Understanding ISO 20022

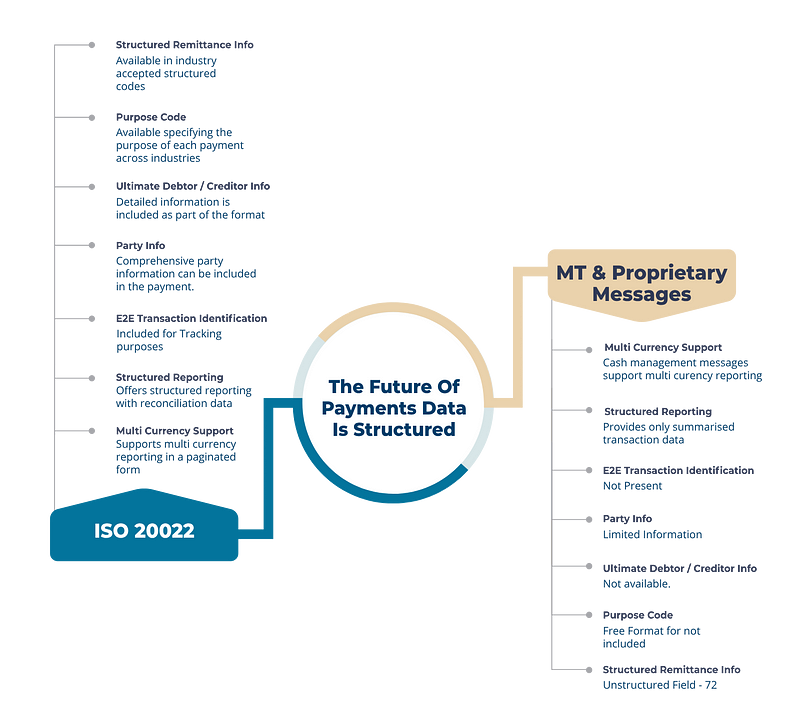

ISO 20022 stands as a globally recognized standard for financial messaging, providing a standardized framework for electronic data exchange between financial institutions. Unlike its predecessors, ISO 20022 boasts rich data capabilities, allowing for the

transmission of detailed information alongside payment instructions.

One of the key advantages of ISO 20022 is its flexibility and adaptability. It supports various payment types, including credit transfers, direct debits, and card payments, making it suitable for a wide range of financial transactions. Moreover, its extensible

design allows for the incorporation of additional data fields, facilitating enhanced compliance, transparency, and interoperability.

The Role of Machine Learning

Machine learning (ML) has emerged as a powerful tool in the financial industry, offering opportunities to automate processes, detect patterns, and optimize decision-making. When applied to cross-border payments, ML algorithms can analyze vast amounts of

transactional data to identify inefficiencies, predict payment flows, and mitigate risks.

One of the primary applications of ML in cross-border payments is fraud detection and prevention. By analyzing historical transaction data, ML models can learn to recognize suspicious patterns and flag potentially fraudulent activities in real-time. This

not only helps protect financial institutions and their customers but also enhances trust and confidence in the payment system.

ML algorithms can also optimize payment routing and settlement processes, ensuring transactions are routed through the most cost-effective and efficient channels. By considering factors such as currency exchange rates, transaction fees, and regulatory requirements,

these algorithms can help minimize costs and reduce processing times for cross-border payments.

Integration and Collaboration

The true potential of ISO 20022 and machine learning in streamlining cross-border payments lies in their integration and collaboration. By leveraging the rich data capabilities of ISO 20022 messages, financial institutions can feed more granular and structured

data into ML models, enhancing their accuracy and performance.

As suggested by the Bank of International Settlements, collaboration between financial institutions, fintech startups, and regulatory bodies is essential to drive innovation and standardization in the cross-border payments ecosystem.

Here’s a simplified example of how machine learning can analyse trends from ISO 20022 payment data:

Data Collection: Gather ISO 20022 payment data from various sources such as banks, financial institutions, or payment processors. This data typically includes information like transaction amounts, timestamps, sender and receiver information, transaction

types, and any relevant metadata.

Data Preprocessing: Clean and preprocess the raw ISO 20022 data. This step involves tasks such as handling missing values, encoding categorical variables, scaling numerical features, and splitting the data into training and testing sets.

Feature Engineering: Extract relevant features from the ISO 20022 data that can help in detecting trends. These features could include transaction frequency, average transaction amount, transaction volume per customer, transaction patterns over time, and

so on.

Model Selection: Choose appropriate machine learning algorithms for trend detection. Commonly used algorithms for this task include time series analysis techniques like ARIMA (AutoRegressive Integrated Moving Average), machine learning algorithms like decision

trees, random forests, or more advanced methods like deep learning with recurrent neural networks (RNNs) or Long Short-Term Memory (LSTM) networks.

Training the Model: Train the selected machine learning model on the preprocessed ISO 20022 data. The model learns to identify patterns and trends in the data based on the provided features.

Validation and Evaluation: Validate the trained model using a separate validation dataset or through cross-validation techniques. Evaluate the model’s performance using appropriate metrics such as accuracy, precision, recall, or F1-score.

Trend Detection: Once the model is trained and validated, it can be used to detect trends in new ISO 20022 payment data. The model can identify patterns such as increasing or decreasing transaction volumes, unusual spikes in transaction amounts, changes

in customer behavior, and other trends that may be of interest to financial institutions or businesses.

Here is an example of a basic decision tree classifier for trend detection

Continuous Monitoring and Improvement: Continuously monitor the model’s performance over time and retrain it periodically with updated data to ensure that it remains accurate and effective at detecting trends in ISO 20022 payment data.

ISO 20022 Structured Data: Enhancing Cross-Border Payments

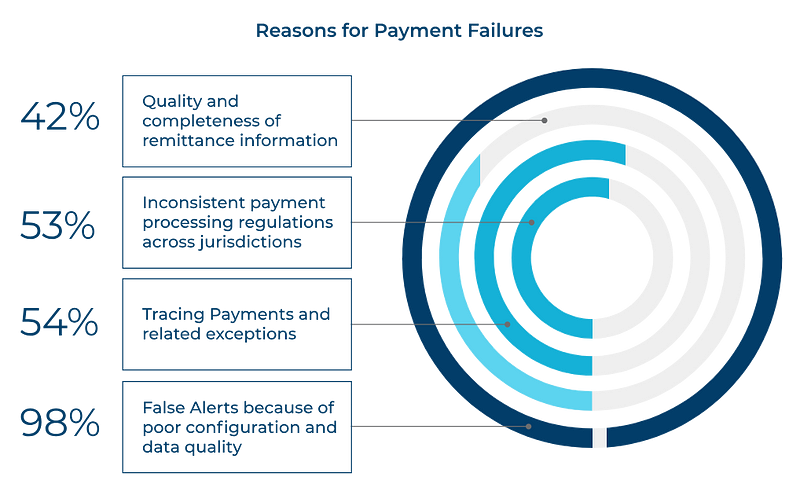

ISO 20022 offers a structured framework for exchanging financial messages, enabling richer and more standardized data to accompany payment instructions. This structured data includes not only essential payment details but also additional information such

as structured postal addresses, remittance data, and purpose codes. Leveraging this structured data can significantly enhance the efficiency, transparency, and accuracy of cross-border payments.

> Structured Postal Addresses

In cross-border payments, accurate address information is crucial for routing payments to the correct beneficiary. ISO 20022 facilitates the inclusion of structured postal addresses within payment messages, ensuring consistency and completeness. These structured

addresses can include elements such as street name, city, postal code, and country code, providing financial institutions with the necessary information to process payments accurately.

> Structured Remittance Information

Remittance information refers to details provided by the payer to the payee, specifying the purpose or context of the payment. ISO 20022 allows for the inclusion of structured remittance data within payment messages, enabling standardized formats for describing

payment references, invoice numbers, and other relevant information. This structured remittance information streamlines reconciliation processes for both the payer and the payee, reducing manual effort and minimizing errors.

Here is an example using NLP for structured data End User view

End User view

> Purpose Codes

Purpose codes are standardized identifiers used to categorize the purpose of a payment, such as salary payments, supplier invoices, or tax payments. ISO 20022 supports the inclusion of purpose codes within payment messages, providing clarity and consistency

in the classification of transactions. These purpose codes facilitate regulatory compliance, financial reporting, and data analysis, enabling financial institutions to track and monitor payment activities more effectively.

Use Cases with Structured Data and Machine Learning

> Address Verification and Correction

Machine learning algorithms can be employed to validate and correct structured postal addresses included in payment messages. By analyzing historical address data and employing address validation techniques, ML models can identify inaccuracies or inconsistencies

in address information and suggest corrections in real-time. This ensures that payments are routed correctly and reduces the risk of payment delays or errors due to invalid address information.

> Automated Remittance Matching

Machine learning algorithms can automate the process of matching structured remittance information with corresponding invoices or payment references. By training on historical data and learning patterns in remittance information, ML models can accurately

identify relevant transactions and reconcile them with corresponding accounts receivable or payable records. This automation streamlines reconciliation processes for businesses, reducing manual effort and accelerating cash flow.

Purpose Code Classification and Reporting

Machine learning algorithms can classify payment transactions based on purpose codes included in payment messages, enabling automated categorization and reporting. By training on labeled data sets and learning patterns in purpose code usage, ML models can

accurately categorize transactions according to their intended purpose, such as payroll, vendor payments, or tax remittances. This classification simplifies regulatory reporting requirements and facilitates financial analysis, enabling financial institutions

to gain insights into payment trends and patterns.

> Fraud Detection and Prevention

Machine learning algorithms can play a crucial role in detecting and preventing fraudulent activities in cross-border payments. By analyzing transactional data and user behavior patterns, these algorithms can identify anomalies and flag suspicious transactions

in real-time. For instance, if a payment is initiated from a location that is unusual for a particular customer or if the transaction deviates from their typical spending habits, ML models can trigger alerts for further investigation. This proactive approach

to fraud detection helps financial institutions mitigate risks and safeguard their customers’ funds.

> Payment Routing Optimization

Optimizing payment routing is another area where machine learning can make a significant impact. By analyzing historical transaction data, ML algorithms can identify the most cost-effective and efficient routes for processing cross-border payments. For example,

if a payment involves currency conversion, ML models can consider factors such as exchange rates, fees charged by intermediary banks, and settlement times to determine the optimal route for the transaction. This not only reduces costs for financial institutions

but also ensures faster and more reliable delivery of funds to the intended recipients.

> Customer Segmentation and Personalized Services

Machine learning techniques can also be used to segment customers based on their payment behavior and preferences, enabling financial institutions to offer personalized services and tailored solutions. For instance, ML algorithms can analyze transaction

data to identify high-value customers who frequently engage in cross-border payments. These customers can then be offered premium services such as faster processing times, discounted fees, or dedicated customer support. By catering to the specific needs of

different customer segments, financial institutions can enhance customer satisfaction and loyalty.

> Compliance and Regulatory Reporting

Compliance with regulatory requirements is a critical aspect of cross-border payments, and machine learning can assist financial institutions in meeting their obligations more efficiently. ML algorithms can analyze transaction data to detect potential instances

of money laundering, terrorist financing, or other illicit activities. By automating the monitoring and reporting process, these algorithms can help financial institutions identify suspicious transactions and ensure compliance with anti-money laundering (AML)

and know your customer (KYC) regulations. This not only reduces the risk of regulatory fines but also strengthens the integrity of the financial system as a whole.

Future Outlook

As technology continues to evolve and regulatory frameworks adapt to new challenges, the future of cross-border payments looks promising. The widespread adoption of ISO 20022, coupled with advancements in machine learning and artificial intelligence, is

poised to revolutionize the way payments are processed, settled, and reconciled on a global scale.

However, it’s important to recognize that with innovation comes responsibility. As we embrace new technologies and standards, we must remain vigilant about cybersecurity threats, data privacy concerns, and the potential for algorithmic biases. Regulatory

oversight and industry best practices will play a crucial role in ensuring the integrity and inclusivity of the cross-border payments infrastructure.

ISO 20022 and machine learning offer a transformative opportunity to streamline cross-border payments, making them faster, cheaper, and more transparent. However, the industry needs to discuss more about harnessing the power of data and technology, unlock

new possibilities for financial inclusion, economic growth, and global cooperation.

It’s time to embrace the future of payments and build a more connected and resilient financial ecosystem for generations to come.