Fintech firms are increasingly reliant on advanced technology to provide innovative financial services.

Gartner forecasts that by 2025, 85% of organizations will prioritize a cloud-first strategy, necessitating cloud-native architectures to meet their digital goals.

Cloud computing is essential for these companies to scale effectively, manage large data volumes, and maintain the reliability and availability of their services.

This guide outlines key factors that fintech companies need to consider when selecting a cloud services provider, ensuring that their decisions are well-informed and tailored to their specific business objectives and needs.

Identifying Your Fintech's Unique Needs

When assessing potential cloud providers, it’s critical to evaluate several vital aspects:

- Data Storage: Determine the necessary data volume and type your application will store, including retention periods and backup strategies.

- Processing Power: Gauge the required computing resources to ensure efficient operation during peak loads and as your enterprise expands.

- Regulatory Compliance: Verify that your provider can comply with important regulations such as GDPR, PCI DSS, or HIPAA.

- Scalability: Confirm that the provider can accommodate growth in users and transaction volumes without degrading performance.

- Security: Focus on the security of your application and customer data, considering data encryption, access controls, and multi-factor authentication.

How to Choose A Cloud Provider

Selecting an appropriate cloud provider is a significant decision for fintech companies:

- Assess Requirements: Define clearly your business, technical, and compliance needs.

- Scalability and Performance: Make sure the provider can dynamically scale resources and possesses data centers in key regions.

- Analyze Costs: Familiarize yourself with various pricing structures and calculate the total ownership cost, accounting for all possible expenses.

- Evaluate Support and SLAs: Review the provider’s support services and service level agreements to confirm they meet your requirements.

- Data Location and Sovereignty: Ensure the provider adheres to data sovereignty laws relevant to your operational regions.

- Integration and Migration: Evaluate how well the provider’s services integrate with your existing systems and the simplicity of migrating your existing workloads.

Different Types of Cloud Infrastructure

It’s crucial to understand the different forms of cloud services:

- Public Cloud: Provides shared resources and scalability at a reduced cost.

- Private Cloud: Offers dedicated resources for greater control and security.

- Hybrid Cloud: Integrates both public and private clouds to allow flexible workload management.

- Multi-Cloud: Employs multiple cloud providers to mitigate reliance on any single vendor.

Key Considerations for Selecting a Cloud Provider

Choosing a cloud provider involves several crucial considerations to ensure a fruitful partnership:

Security & Compliance: Select a provider with robust security measures that complies with industry regulations to protect your operations and data.

Scalability and Performance: Opt for a provider that can support your business’s growth and manage traffic spikes effectively, ensuring consistent performance.

Cost and Pricing Models: Understanding the pricing structure of the provider is crucial to manage your budget effectively and avoid unexpected costs.

Integration and Interoperability: Seamless integration with existing systems and third-party services is vital for operational efficiency and technological adaptation.

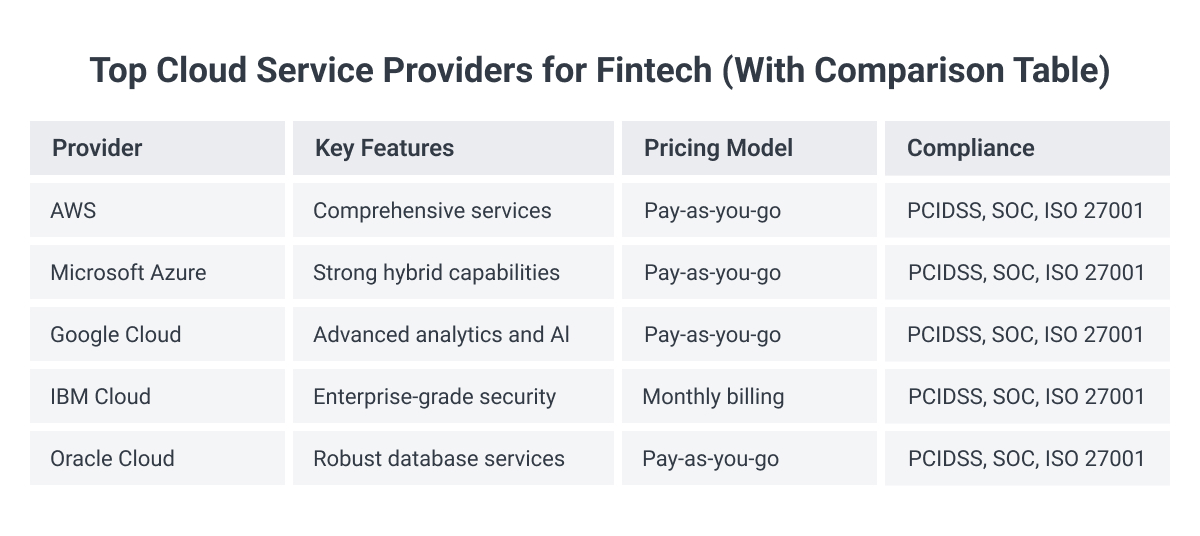

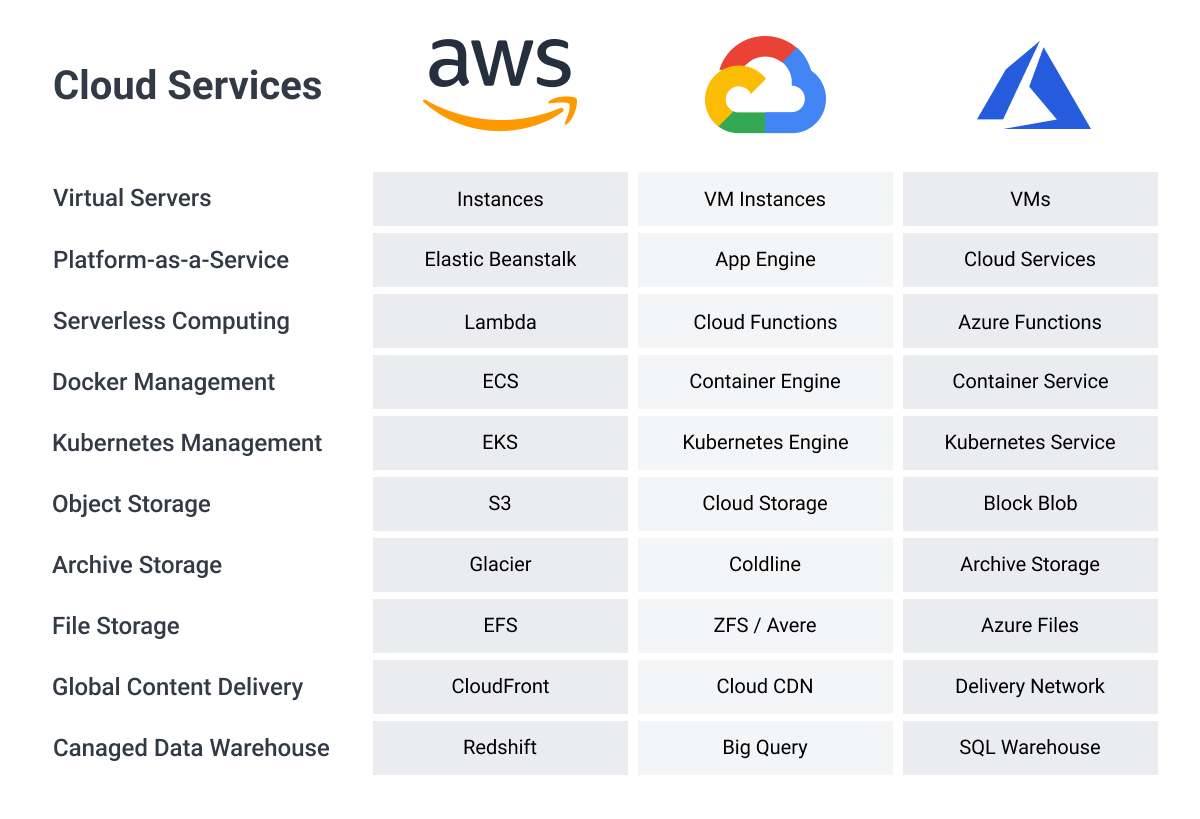

Evaluating Top Cloud Providers for Fintechs

It is advisable to consider prominent providers that are known for their fintech solutions, like

Amazon Web Services,

Microsoft Azure, and Google Cloud, which offer specialized tools and compliance features suitable for the financial services sector.

Final Thoughts

Choosing the right cloud services provider is a foundational decision for fintech companies. A thorough evaluation and comparison of providers based on your specific needs and goals are imperative. We recommend utilizing cloud consulting services to help

make the decision easier - plus, consulting can often help with cloud cost savings in the longterm.

Engaging in trials or proof of concepts provides deeper insights into each provider's capabilities, aiding in making a well-informed decision. This strategic approach is key to ensuring the scalability and success of your fintech in the competitive realm

of financial technology.